A Deep Dive into Widely Used Technologies

Financial technology, or fintech, has emerged as a game-changer in the world of finance, revolutionizing how individuals and businesses manage their money. In recent years, a plethora of fintech solutions has flooded the market, offering innovative ways to handle transactions, investments, and overall financial well-being. In this blog post, we will delve into some of the widely used fintech technologies that are reshaping the financial landscape.

Mobile Payments and Digital Wallets

One of the most visible and impactful aspects of fintech is the rise of mobile payments and digital wallets. Services like PayPal, Venmo, and Square Cash have transformed the way people make transactions. The convenience of sending and receiving money through mobile apps has made traditional banking seem archaic. With just a few taps on a smartphone, users can split bills, pay for goods and services, and even contribute to charitable causes.

Digital wallets, such as Apple Pay and Google Pay, take this a step further by allowing users to store credit card information securely on their devices. This eliminates the need for physical cards and enhances the speed and security of transactions.

Blockchain and Cryptocurrencies

Blockchain, the underlying technology of cryptocurrencies like Bitcoin and Ethereum, has garnered significant attention for its potential to revolutionize the financial industry. The decentralized nature of blockchain ensures transparency, security, and immutability of transactions. This technology has the potential to disrupt traditional banking systems by providing faster and more cost-effective cross-border transactions.

Cryptocurrencies, often associated with blockchain, have become increasingly popular as alternative investment vehicles. Bitcoin, the pioneer in this space, has paved the way for numerous other digital currencies, each with its unique features and use cases. Investors and enthusiasts alike are closely watching the evolution of this decentralized financial ecosystem.

Robo-Advisors

Robo-advisors have democratized investment management by providing automated, algorithm-driven financial planning services with minimal human intervention. These platforms analyze user preferences, risk tolerance, and financial goals to create diversified investment portfolios. Popular robo-advisors like Betterment and Wealthfront have gained traction, especially among millennials seeking low-cost, user-friendly investment options.

The advantages of robo-advisors include lower fees compared to traditional financial advisors and the ability to rebalance portfolios automatically. However, concerns about the lack of personalized human advice and potential algorithmic biases have prompted ongoing discussions within the industry.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms have disrupted traditional lending models by connecting borrowers directly with individual lenders. Platforms like LendingClub and Prosper enable individuals to borrow money without going through traditional financial institutions. This model often results in more favorable interest rates for borrowers and higher returns for lenders.

The success of P2P lending has prompted the development of similar models in other financial sectors, including real estate crowdfunding and small business financing. However, regulatory challenges and the need for robust risk management practices remain ongoing concerns for the P2P lending industry.

Insurtech Innovations

Insurance technology, or insurtech, is reshaping the insurance industry by leveraging technology to streamline processes, reduce costs, and enhance user experiences. Insurtech solutions encompass various areas, including digital policy issuance, claims processing automation, and usage-based insurance.

Companies like Lemonade have introduced AI-driven chatbots to simplify the insurance buying process, while others utilize telematics devices to monitor driving behavior for personalized auto insurance premiums. The integration of big data and artificial intelligence has significantly improved risk assessment and fraud detection in the insurance sector.

Open Banking and APIs

Open banking initiatives aim to promote competition and innovation by allowing third-party financial service providers to access consumer banking data through application programming interfaces (APIs). This approach enables the development of new financial products and services that leverage existing banking infrastructure.

The use of APIs has become widespread in the fintech space, facilitating seamless integration between different financial platforms. Developers can create innovative solutions by accessing data securely with user consent, leading to a more interconnected and dynamic financial ecosystem.

Artificial Intelligence in Financial Services

Artificial intelligence (AI) is increasingly being employed in various aspects of financial services, from customer service chatbots to algorithmic trading. Machine learning algorithms analyze vast amounts of financial data to provide insights, automate decision-making processes, and enhance fraud detection.

Chatbots powered by natural language processing (NLP) have improved customer interactions in banking and investment platforms. Additionally, AI-driven robo-advisors utilize advanced algorithms to optimize investment strategies based on market trends and user preferences.

The Future of Fintech: Trends to Watch

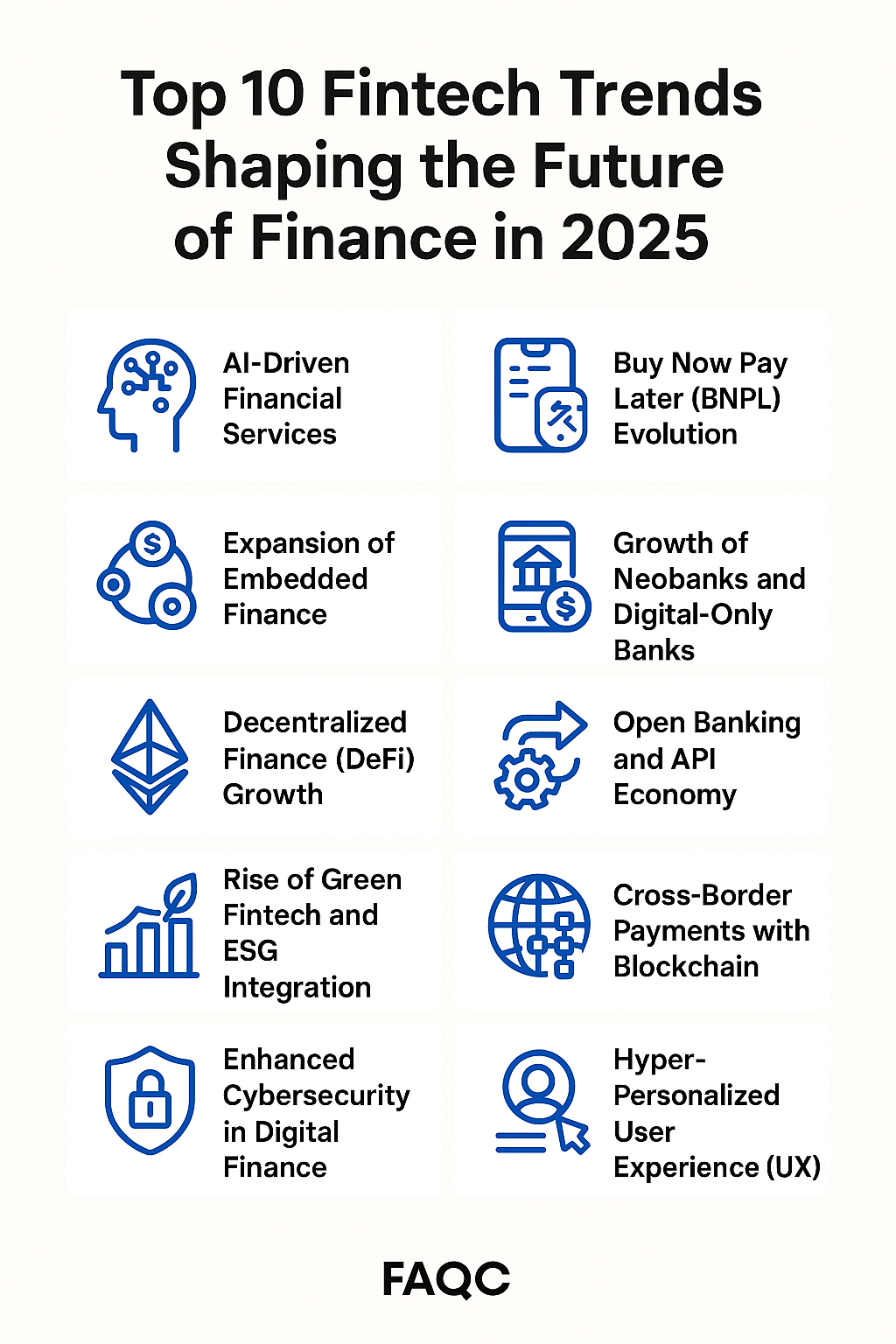

As fintech continues to evolve, several trends are poised to shape its future trajectory. Central bank digital currencies (CBDCs), decentralized finance (DeFi) platforms, and the integration of quantum computing are among the areas garnering attention.

CBDCs, backed by central authorities, aim to digitize traditional currencies and provide a government-backed alternative to cryptocurrencies. DeFi platforms, operating on blockchain technology, seek to decentralize financial services, including lending, borrowing, and trading. Quantum computing holds the potential to revolutionize cryptography and significantly impact the security measures currently in place.

The world of fintech is dynamic and continually evolving, driven by technological advancements and changing consumer expectations. Mobile payments, blockchain, robo-advisors, P2P lending, insurtech, open banking, and artificial intelligence are just a glimpse into the multifaceted landscape of fintech innovations.

As we move forward, it is crucial for industry participants, regulators, and consumers to navigate the opportunities and challenges presented by these transformative technologies. Fintech has undoubtedly democratized financial services, providing individuals and businesses with unprecedented access to innovative solutions. However, it also raises questions about data privacy, security, and the potential for widening socioeconomic disparities.

In this era of rapid technological change, staying informed about the latest fintech developments is essential for making informed financial decisions and understanding the broader implications of these innovations on the global economy. Whether you are an investor, a financial professional, or an everyday consumer, embracing the possibilities and staying vigilant about the risks will be key to navigating the exciting and complex world of fintech.