Fintech General & Industry Trends: Understanding the Future of Financial Technology

Introduction to Fintech

In today’s rapidly evolving digital economy, Fintech General & Industry Trends are revolutionizing how individuals and businesses interact with money. Financial technology—commonly known as fintech—is not just a buzzword anymore; it represents a structural shift in financial services. By leveraging technologies such as AI, blockchain, and cloud computing, fintech is making financial processes more efficient, transparent, and accessible.

This article provides a deep and detailed exploration of Fintech General & Industry Trends, offering insights into where the industry stands today and what lies ahead.

What is Fintech?

Fintech General & Industry Trends revolve around the use of innovative technology to enhance or automate financial services. This includes everything from mobile banking and peer-to-peer lending to cryptocurrency exchanges and robo-advisory platforms. Fintech bridges the gap between traditional finance and the modern digital user, emphasizing speed, efficiency, and customization.

Historical Evolution of Fintech

The roots of Fintech General & Industry Trends can be traced back to the late 20th century with the introduction of credit cards and ATMs. However, the true fintech revolution began in the 2000s with online banking, and it exploded after the 2008 financial crisis. The crisis exposed inefficiencies in traditional banking and opened the door for tech-driven alternatives.

From Traditional Banking to Digital Finance

This shift from legacy systems to digital platforms is the core of Fintech General & Industry Trends, where agility and innovation have become the new norms.

Why Fintech is Booming

The surge in Fintech General & Industry Trends can be attributed to the growing demand for better customer experience, real-time access to financial data, and inclusive banking solutions. Millennials and Gen Z, in particular, prefer mobile-first solutions that offer instant gratification and transparent pricing.

Global Market Growth

As per industry reports, the global fintech market is expected to surpass $500 billion by 2030. The rapid acceleration of digital transformation during the pandemic further amplified Fintech General & Industry Trends, pushing both consumers and businesses toward tech-enabled finance.

Technological Enablers

At the heart of Fintech General & Industry Trends are the technologies that make innovation possible.

AI, Blockchain, and Cloud Computing

Artificial Intelligence enables personalized services and fraud prevention. Blockchain ensures secure, transparent transactions. Cloud platforms facilitate scalable solutions. Together, these technologies define the backbone of Fintech General & Industry Trends in 2025 and beyond.

Core Fintech Segments Driving Change

Understanding Fintech General & Industry Trends means analyzing the core segments that dominate this landscape.

Digital Payments

Digital wallets and contactless payments are reshaping retail and e-commerce. Apple Pay, PayPal, and Stripe lead this transformation, which is central to Fintech General & Industry Trends.

Peer-to-Peer (P2P) Lending

P2P platforms allow borrowers to access funds without intermediaries. This is one of the clearest examples of Fintech General & Industry Trends disrupting traditional finance models.

Insurtech

Insurtech firms are redefining risk assessment and policy customization through machine learning. This aligns closely with Fintech General & Industry Trends focused on data-driven efficiency.

WealthTech and Robo-Advisors

Services like Betterment and Wealthfront automate investment strategies, making wealth management more accessible—an essential part of Fintech General & Industry Trends aimed at democratizing finance.

RegTech and Compliance Automation

RegTech tools help companies stay compliant in complex regulatory environments. This trend in regulatory technology is becoming increasingly critical in Fintech General & Industry Trends.

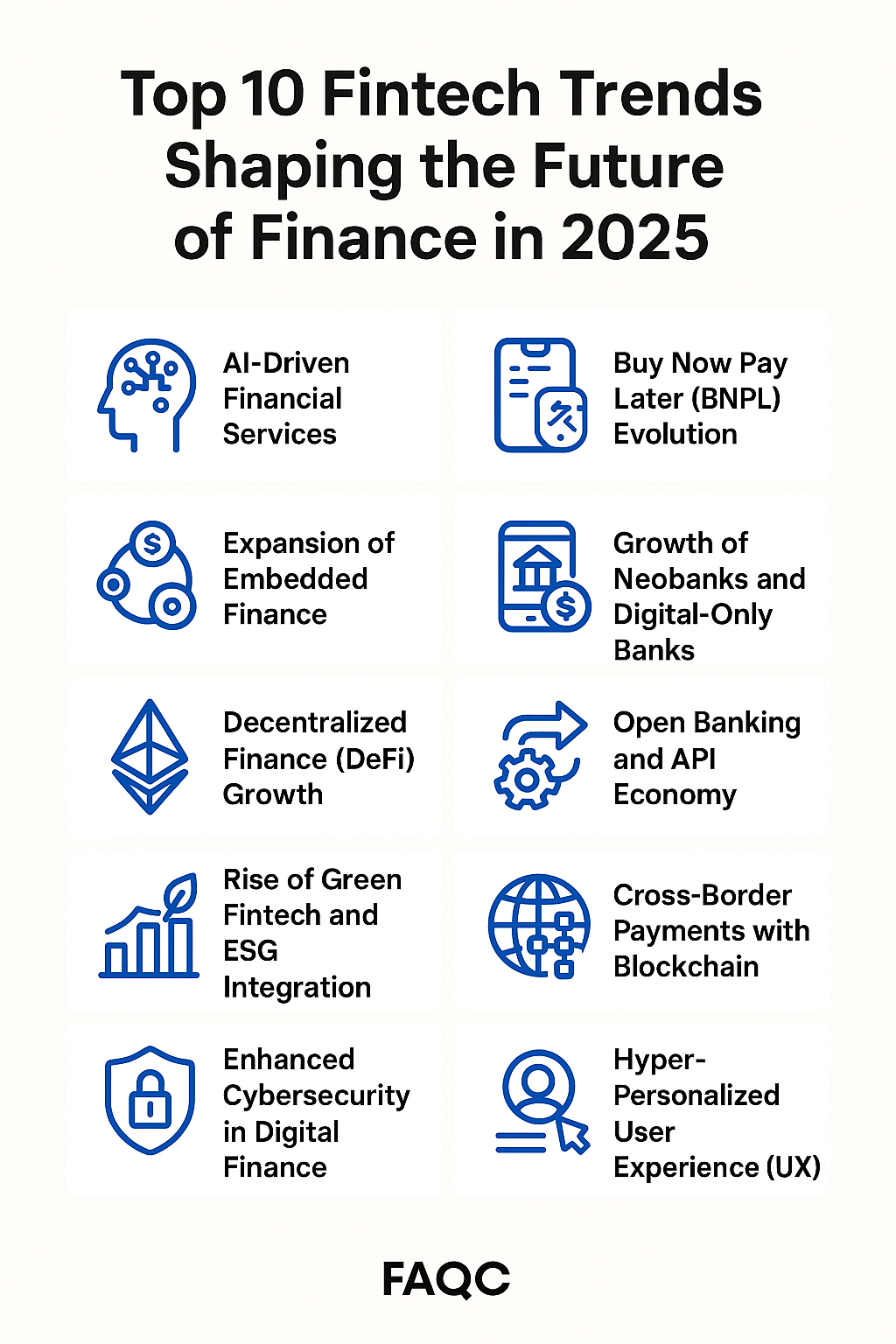

Top Fintech General & Industry Trends in 2025

Let’s look at the current and emerging Fintech General & Industry Trends that are shaping the financial world in 2025.

Rise of Embedded Finance

Embedded finance allows non-financial platforms to offer financial services. Think of hailing a ride and buying insurance within the same app. This seamless integration is one of the most transformative Fintech General & Industry Trends.

Expansion of BNPL Models

Buy Now, Pay Later services like Klarna and Afterpay are offering new credit models to young consumers. As part of broader Fintech General & Industry Trends, BNPL is redefining short-term lending.

Cross-Border Fintech Services

Globalization has prompted the need for smooth international payments. Fintech players like Wise (TransferWise) offer cost-effective, quick solutions, reflecting one of the strongest Fintech General & Industry Trends in international finance.

Decentralized Finance (DeFi)

DeFi protocols eliminate middlemen and use blockchain to offer financial products directly to users.

Smart Contracts and Tokenization

Smart contracts automate processes like lending and settlement. Tokenization of assets is gaining traction, both being essential to Fintech General & Industry Trends in blockchain ecosystems.

Fintech and Financial Inclusion

A crucial aspect of Fintech General & Industry Trends is how it brings financial tools to underserved populations.

Empowering the Unbanked Population

Over 1.7 billion people globally remain unbanked. Fintech platforms offer mobile solutions that bypass traditional barriers, making this a cornerstone of Fintech General & Industry Trends.

Mobile Banking in Developing Nations

In countries like Kenya and India, mobile banking has seen unprecedented adoption. These platforms are vital to advancing Fintech General & Industry Trends focused on global equity.

Micro-Investment Platforms

Apps like Acorns allow users to invest spare change. These services cater to beginners, aligning with Fintech General & Industry Trends in financial democratization.

Consumer Behavior and Fintech Adoption

Consumer expectations are evolving rapidly, driving Fintech General & Industry Trends forward.

Changing Expectations Around Convenience

Users demand instant access, easy interfaces, and real-time alerts. Fintech delivers on all fronts, embodying the core of Fintech General & Industry Trends.

Mobile-First Financial Engagement

Today’s users often manage their entire financial life from their smartphones. This digital shift supports Fintech General & Industry Trends centered around mobile-first strategies.

The Role of UX in Fintech Success

Great UX differentiates winners in the fintech space. Simplicity and functionality are critical pillars of successful Fintech General & Industry Trends.

Traditional Banking’s Response to Fintech

Banks aren’t just watching; they’re adapting.

Collaboration Over Competition

Partnerships between banks and startups are on the rise. These collaborations are part of Fintech General & Industry Trends aimed at modernization.

Open Banking APIs and Partnerships

APIs enable third-party developers to build services on top of banking data. This open ecosystem is a vital trend in Fintech General & Industry Trends promoting interoperability.

In-house Innovation Labs

Banks are establishing innovation labs to incubate new fintech ideas internally. This internal restructuring supports Fintech General & Industry Trends by encouraging agile thinking.

Regulatory Landscape of Fintech

Regulation is both a challenge and an opportunity in Fintech General & Industry Trends.

Global Regulatory Variances

Different regions have different rules, impacting fintech growth globally. Harmonization efforts are now central to Fintech General & Industry Trends in regulatory tech.

Data Privacy and Cybersecurity

With greater digital access comes increased risk. Fintech companies must prioritize security, making it a cornerstone of Fintech General & Industry Trends in compliance.

GDPR, CCPA, and Beyond

Adherence to global data regulations is a non-negotiable part of Fintech General & Industry Trends, especially as companies scale internationally.

ESG and Sustainable Fintech

Sustainability is another major facet of Fintech General & Industry Trends.

Green Finance Solutions

Platforms that support carbon offsets or green bonds are gaining popularity. These innovations align fintech with sustainability—a growing Fintech General & Industry Trend.

Impact Investing Platforms

Apps like Aspiration let users invest in companies aligned with their values. This socially responsible finance model is a significant aspect of Fintech General & Industry Trends.

Fintech’s Role in ESG Reporting

Many fintech startups provide tools for environmental, social, and governance reporting, highlighting their relevance in Fintech General & Industry Trends tied to responsible investing.

Artificial Intelligence in Fintech

AI is a transformative force across Fintech General & Industry Trends.

AI for Risk Assessment

Machine learning models offer faster and more accurate credit risk evaluations. This efficiency is at the heart of Fintech General & Industry Trends in AI.

Fraud Detection Using Machine Learning

AI algorithms can detect suspicious activity in real-time, enhancing security—a vital part of Fintech General & Industry Trends in digital trust.

Personalized Financial Advice

Chatbots and robo-advisors provide tailored financial guidance, streamlining personal finance—yet another highlight of Fintech General & Industry Trends.

Blockchain’s Transformative Role in Fintech

The decentralization movement plays a key role in Fintech General & Industry Trends.

Beyond Bitcoin – Real Use Cases

Blockchain is now used in supply chain, insurance, and KYC protocols. These practical uses reflect the maturing of Fintech General & Industry Trends in blockchain.

Blockchain in KYC and Identity Verification

Blockchain can securely store and verify user identities, solving one of finance’s biggest pain points—integral to Fintech General & Industry Trends in identity solutions.

The Future of Fintech: What Lies Ahead

Looking forward, Fintech General & Industry Trends suggest continued innovation.

Predictive Trends in Fintech Development

Trends include biometric authentication, real-time credit scoring, and quantum computing integration—signaling advanced phases of Fintech General & Industry Trends.

The Rise of Super Apps

Platforms combining banking, shopping, investing, and insurance are emerging. Super apps are the next big thing in Fintech General & Industry Trends for all-in-one experiences.

All-in-One Digital Financial Ecosystems

By aggregating services under one roof, super apps simplify life—advancing Fintech General & Industry Trends in ecosystem-driven finance.

Conclusion: Embracing Innovation in the Financial Industry

Fintech is no longer just an alternative—it is the future. Whether through personalized banking, AI-powered investments, or blockchain-enabled payments, the world of finance is changing fast. Staying informed about Fintech General & Industry Trends is not just useful—it’s essential for businesses, consumers, and policymakers alike.

As we move forward, one thing is certain: those who adapt to Fintech General & Industry Trends will lead the financial world of tomorrow.

Frequently Asked Questions (FAQ)

1. What are Fintech General & Industry Trends?

Fintech General & Industry Trends refer to the evolving patterns and innovations within the financial technology sector. These include developments in digital payments, blockchain, AI, RegTech, decentralized finance (DeFi), and mobile-first solutions that are reshaping how individuals and businesses manage financial activities.

2. Why are Fintech General & Industry Trends important in 2025?

As we progress into a digitally dominated world, Fintech General & Industry Trends play a crucial role in making financial services more accessible, transparent, and efficient. These trends shape how consumers interact with money and influence global economic growth through innovative technologies.

3. How does AI contribute to Fintech General & Industry Trends?

Artificial Intelligence is central to Fintech General & Industry Trends, offering capabilities like personalized financial advice, real-time fraud detection, and advanced risk modeling. AI helps fintech companies create smarter, faster, and more user-centric products and services.

4. What role does blockchain play in Fintech General & Industry Trends?

Blockchain underpins several Fintech General & Industry Trends, especially in areas like decentralized finance (DeFi), secure transactions, digital identity verification, and smart contracts. Its decentralized nature allows for transparency, security, and trustless financial systems.

5. Are Fintech General & Industry Trends replacing traditional banks?

While fintech companies are disrupting legacy systems, Fintech General & Industry Trends are also pushing traditional banks to innovate. Instead of outright replacement, a hybrid financial ecosystem is emerging, where collaboration and digital transformation are key.

6. How are consumers affected by Fintech General & Industry Trends?

Consumers benefit significantly from Fintech General & Industry Trends through easier access to financial tools, lower fees, faster services, and personalized digital experiences. These trends empower users to have more control and flexibility over their finances.

7. Which technologies are leading the Fintech General & Industry Trends?

Key technologies powering Fintech General & Industry Trends include artificial intelligence, machine learning, blockchain, biometrics, cloud computing, and open APIs. Each of these plays a role in building more agile and inclusive financial platforms.

8. What is the future of Fintech General & Industry Trends?

The future of Fintech General & Industry Trends points to the rise of super apps, expanded financial inclusion, ESG-focused platforms, and integrated services across global markets. Continued regulatory evolution and tech innovation will further define the trajectory of fintech.

9. How can businesses keep up with Fintech General & Industry Trends?

To stay ahead, businesses should invest in digital transformation, explore partnerships with fintech firms, and monitor Fintech General & Industry Trends regularly. Adapting to consumer expectations and regulatory changes is vital for sustainable growth.

10. Are Fintech General & Industry Trends safe and regulated?

Yes, many Fintech General & Industry Trends are governed by strict compliance frameworks such as GDPR, CCPA, and regional financial authorities. Security protocols and regulatory tech (RegTech) are continuously advancing to ensure safe financial operations.