How Fintech is Disrupting Traditional Banking: A Deep Dive

Introduction to the Fintech Revolution

The financial industry is undergoing a monumental transformation driven by technology. The rise of financial technology—commonly known as fintech—has disrupted nearly every aspect of the traditional banking model. From mobile banking apps to decentralized finance platforms, how fintech is disrupting traditional banking is no longer a hypothetical—it’s a reality.

Long gone are the days when customers had to visit physical branches for every transaction. Today, fintech startups and digital-first institutions are redefining convenience, personalization, and financial inclusion. In this deep dive, we explore how technology is reshaping finance, what this means for banks, and what the future holds.

What is Fintech?

Fintech, short for financial technology, refers to innovative digital tools and platforms that improve and automate the delivery of financial services. These range from peer-to-peer payment systems like Venmo to investment apps like Robinhood. The goal? To make financial services more accessible, user-friendly, and efficient.

When we discuss how fintech is disrupting traditional banking, we’re looking at more than just new apps. We’re witnessing a shift in how financial products are created, distributed, and consumed.

The Evolution of Traditional Banking

Traditional banking has served as the backbone of financial systems for centuries. However, these institutions often rely on legacy systems—outdated software and bureaucratic processes—that hinder innovation. As fintech firms introduce nimble, cloud-native alternatives, banks struggle to keep pace.

From high fees to slow processing times, traditional banks are losing customer trust and relevance in an increasingly digital economy. This transformation highlights how fintech is reshaping traditional financial services globally.

Why Fintech is Reshaping Financial Services

Consumers today demand seamless digital experiences. Fintech delivers exactly that—with fast onboarding, real-time notifications, data-driven insights, and on-demand support. This level of personalization and responsiveness is something traditional banks have historically lacked.

The disruption is rooted in solving pain points—be it avoiding overdraft fees or accessing loans without a credit score. These tech-driven solutions illustrate how fintech is revolutionizing traditional banking operations in every corner of the market.

The Core Technologies Powering Fintech

To understand how fintech is transforming banking, we need to explore the technology behind it.

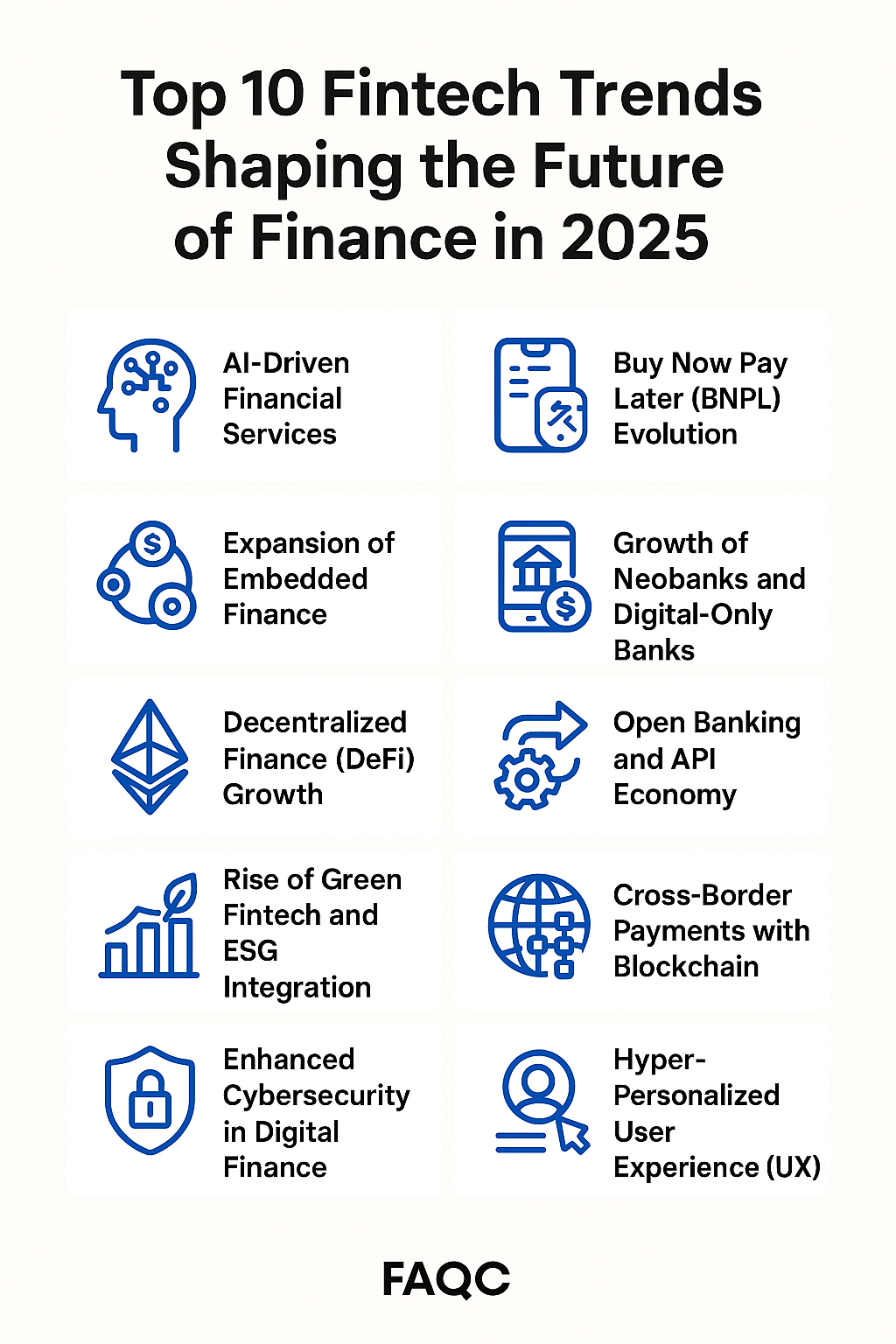

Artificial Intelligence and Machine Learning in Fintech

AI and ML enable predictive analytics, fraud detection, and hyper-personalized customer service. Fintech platforms use these tools to tailor loan offerings, assess risk in real-time, and even create chatbots that mimic human agents.

This advanced tech integration shows how AI-driven fintech is redefining customer experience in banking.

Blockchain and Decentralized Finance (DeFi)

Blockchain is the engine behind decentralized financial ecosystems. It powers cryptocurrencies, smart contracts, and DeFi apps—disrupting traditional banking by removing intermediaries and increasing transparency.

From Ethereum to stablecoins, blockchain is the backbone of fintech’s disruption of traditional banking systems.

Big Data and Predictive Analytics

Fintech firms leverage massive data sets to offer personalized financial recommendations. Whether it’s budgeting tools or credit scoring, big data is key to modern finance.

This focus on data analytics underlines how fintech uses big data to outpace traditional banking models.

Cloud Computing and Infrastructure Scaling

Cloud computing allows fintech companies to scale faster and reduce costs. Unlike banks bogged down by internal servers, cloud-native fintech firms can update products and deploy features instantly.

This tech infrastructure is central to why fintech is growing faster than traditional financial institutions.

API Banking and Open Finance

APIs enable seamless integrations between fintech apps and traditional banking systems. Open banking initiatives empower consumers to control and share their financial data securely, driving innovation and competition.

Open finance APIs are a cornerstone of how fintech collaborates and competes with traditional banks.

How Fintech is Disrupting Traditional Banking Services

The ripple effects of fintech can be seen across every financial product and service.

Mobile Banking and Neobanks

Neobanks like Chime, N26, and Monzo offer mobile-first platforms with no branches. They appeal to digital natives by offering no-fee checking, early direct deposit, and sleek interfaces.

This model exemplifies how mobile-first fintech banks are challenging brick-and-mortar banking.

Peer-to-Peer (P2P) Lending Platforms

Platforms like LendingClub and Prosper bypass traditional banks by connecting borrowers with individual investors. This model democratizes access to capital and often provides better rates.

Peer lending is one of the clearest examples of fintech displacing traditional loan services.

Robo-Advisors in Wealth Management

Companies like Betterment and Wealthfront use algorithms to manage investments based on user preferences. This automation reduces fees and barriers to entry.

Robo-advising showcases how fintech is disrupting traditional wealth management firms.

Digital Wallets and Contactless Payments

Digital wallets such as PayPal, Apple Pay, and Google Wallet make payments frictionless. These fintech tools bypass banks entirely in daily financial transactions.

This technology shift illustrates how digital payments are reducing reliance on traditional banking channels.

Real-Time Money Transfers and Remittances

Platforms like Wise (formerly TransferWise) enable global transfers at low fees and near-instant speeds. This is a game-changer in cross-border banking.

Real-time transfers prove how fintech is solving problems traditional banks couldn’t address efficiently.

Cryptocurrency Integration into Mainstream Finance

While not yet fully mainstream, crypto is inching closer to being a part of everyday finance. Bitcoin ATMs, crypto debit cards, and institutional adoption show a rising trend.

The inclusion of digital assets highlights how fintech is introducing new currencies into the banking world.

Impact on Consumer Behavior and Expectations

The fintech era has created a new generation of financially-savvy, empowered consumers.

The Rise of Digital-First Consumers

Today’s users expect 24/7 access, instant approvals, and seamless interfaces. This demand is pushing banks to upgrade or get left behind.

Fintech’s user-first design explains how changing consumer expectations are disrupting traditional banks.

Personalization and On-Demand Financial Services

Fintech apps track spending, offer tailored advice, and even send alerts before you overdraft. Personalization at scale is becoming the norm.

This consumer-centric focus is central to how fintech creates competitive pressure on traditional banking.

Financial Inclusion Through Technology

Fintech has opened doors for individuals previously excluded from financial systems.

Serving the Underbanked and Unbanked Populations

From mobile loans in Africa to gig worker accounts in the U.S., fintech is building inclusive solutions.

This democratization underscores how fintech promotes financial inclusion better than traditional banks.

Challenges Faced by Traditional Banks

Banks are not standing still, but they face steep challenges.

Legacy Infrastructure and Digital Transformation

Outdated IT systems slow down innovation. Banks spend billions just maintaining aging tech stacks.

This is a major reason why traditional banks struggle to keep up with fintech innovation.

Regulatory Pressure and Compliance Challenges

Banks are subject to rigorous compliance rules that slow down product releases and experimentation. Meanwhile, fintech startups often operate in more flexible regulatory environments.

This disparity illustrates how regulation impacts the pace of fintech versus banking disruption.

Loss of Market Share to Agile Startups

Fintech startups can pivot quickly, launching features in weeks instead of years. This agility is a major competitive edge.

The growing adoption of fintech is a clear sign of how traditional banks are losing market share.

Case Studies of Fintech Disruption

Revolut and the Rise of Neobanks

Revolut offers multi-currency accounts, crypto trading, and fee-free global spending—all from a single app. It’s redefining what a bank can be.

Stripe: Reinventing Payments

Stripe powers online payments for companies of all sizes, eliminating much of the friction traditional merchant accounts once caused.

Robinhood: Changing the Investment Landscape

Robinhood’s commission-free trading and mobile-first design forced major brokerage firms to eliminate trading fees—a massive industry shift.

Each case study exemplifies how fintech companies are setting new industry standards and forcing legacy institutions to adapt.

Opportunities for Collaboration

Not all banks view fintech as a threat—many are finding ways to partner and co-create.

Fintech-Bank Partnerships and API Integration

Banks are integrating fintech features via APIs to modernize their services without building from scratch.

Banking-as-a-Service (BaaS) Platforms

Some banks now act as back-end providers for fintech firms, allowing them to offer compliant, FDIC-insured services.

Innovation Labs and Accelerators

Banks are funding innovation labs or investing in startups to stay ahead of disruption.

These collaborations show how fintech and banks can coexist to improve the financial ecosystem.

Regulatory Landscape in Fintech

Balancing Innovation with Compliance

While fintech encourages speed and experimentation, regulators must ensure consumer protection and financial stability.

Global Fintech Regulations: A Comparative Look

The U.S., EU, and Asia each have different approaches to regulating fintech—shaping how companies grow in those regions.

Data Privacy and Cybersecurity in Financial Technology

As fintech apps handle sensitive data, they must uphold rigorous cybersecurity protocols and privacy policies.

These evolving standards highlight how compliance will shape the future of fintech innovation.

The Future of Banking in a Fintech World

Hybrid Models: Traditional + Digital

Expect to see more hybrid models where banks offer digital products while maintaining legacy services for certain demographics.

Predicting the Next Wave of Disruption

Embedded finance, AI-driven underwriting, and decentralized identity systems could redefine finance in the coming decade.

Preparing for a Cashless, AI-Driven Economy

As digital and contactless payments grow, cash could become obsolete—reshaping how we think about money itself.

Frequently Asked Questions (FAQ)

Is fintech replacing banks?

Not entirely. Fintech is transforming how banks operate, but many institutions are adapting through collaboration and innovation.

How secure are fintech platforms?

Top-tier fintech firms invest heavily in encryption, authentication, and fraud detection. Still, users should research and use trusted apps.

Can banks survive without going digital?

Unlikely. Digital transformation is essential for banks to stay competitive in a fintech-dominated future.

Conclusion: Embracing Change in Financial Services

Fintech is no longer a fringe movement—it’s the future of finance. From how we send money to how we invest and borrow, these tools are redefining every financial interaction. While traditional banks face steep challenges, those willing to adapt, collaborate, and innovate have a clear path forward.

Understanding how fintech is disrupting traditional banking is not just important for institutions but for every consumer navigating the digital economy.